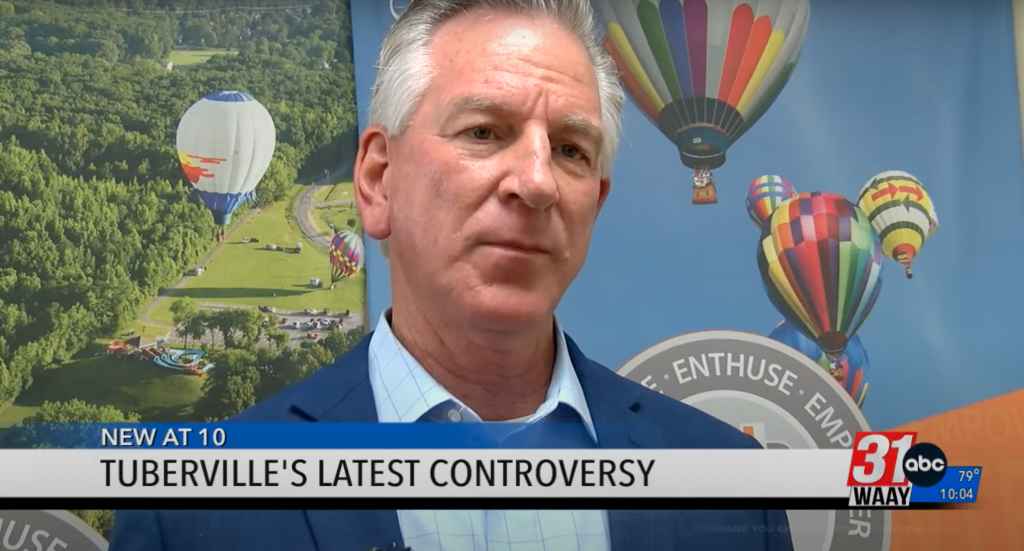

Tommy Tuberville Regularly Trades Stocks of Industries He Oversees

Key Facts about Senator Tommy Tuberville’s Trading Controversies

- Senator Tuberville has a history of making controversial stock trades, particularly in the healthcare sector.

- His committee role in overseeing the healthcare industry contrasts with his personal financial engagements in the same sector.

- There have been reported instances of late trade disclosures by the Senator.

- His investments in a Chinese company with ties to the Communist Party are at odds with his public statements.

- He has had violations of the STOCK Act, a law designed to prevent insider trading and promote transparency.

- Public sentiment leans heavily toward stricter regulations or bans on congressional stock trading.

- Senator Tuberville’s views on stock trading restrictions diverge from the concerns of a majority of the American public.

Examining Senator Tommy Tuberville’s Ethical Controversies in Stock Trading

Senator Tommy Tuberville’s stock trading activities have sparked significant debate about the ethics of congressional stock trading.

His actions, especially in relation to his role on key Senate committees, demonstrate potential conflicts of interest and the erosion of public trust in government.

Controversial Trades and Conflicts of Interest

Senator Tuberville’s financial engagements in the healthcare sector, given his committee role overseeing this industry, are of paramount concern. The juxtaposition of these personal financial interests and his official capacity highlights the ethical dilemmas inherent in such activities.

The late reporting of his trades further intensifies the issues, implying a possible lapse in transparency critical for public officials.

Beyond the healthcare sector, his decisions to bet against prominent international market players come under scrutiny, given the potential consequences these trades might bear on U.S. foreign policy and economic interests.

Furthermore, his investments in a Chinese company known to have affiliations with the Communist Party, contrasting starkly with his public remarks, raise eyebrows. Such financial choices are contentious, both for potential national interest conflicts and for the dissonance they create against his public image.

Violations of the STOCK Act

The STOCK Act is pivotal in maintaining public trust, aiming to deter insider trading and champion transparency among U.S. lawmakers. Senator Tuberville’s consistent breaches of this act, requiring timely stock trade disclosures, underscore deeper concerns about alignment with expected legal and ethical standards for public representatives.

The Public’s Stance on Lawmakers’ Stock Trading

The growing unease about congressional stock trading is palpable, with a significant majority pushing for more stringent regulations or outright bans. This sentiment underscores the chasm between public expectations and the practices of some elected officials.

Contrasting this public opinion, Senator Tuberville’s own stance on stock trading restrictions, dismissing them as “ridiculous” and commenting on their prospective effects on the composition of Congress, reflects a position misaligned with the American populace.

Bibliography

- Cleveland-Stout, N. “Who held defense stocks while making national security policy?” Responsible Statecraft, September 16, 2022. https://responsiblestatecraft.org/2022/09/16/lawmakers-making-national-security-policy-trade-in-defense-stocks/

- Echols, C. “Why did Sen. Tuberville bet against this Taiwan company in stock trade?” Responsible Statecraft, April 28, 2023. https://responsiblestatecraft.org/2023/04/28/senators-bet-against-taiwanese-semiconductor-giant-is-a-clear-conflict-of-interest/

- Garcia, E. “Repeat STOCK Act violator Sen Tommy Tuberville calls trading ban for Congress ‘ridiculous’.” The Independent, February 9, 2022. https://www.the-independent.com/news/world/americas/us-politics/tommy-tuberville-stock-ban-congress-b2011612.html

- Hartung, W., & Fisher, D. “Buying and selling arms stock while voting on war should be illegal.” Responsible Statecraft, July 25, 2023. https://responsiblestatecraft.org/2023/07/25/buying-arms-industry-stock-while-voting-on-war-seems-like-it-should-be-illegal/

- Koplowitz, H. “Tuberville’s financial trades include 20 ‘possible conflicts’ of interest with Senate business.” AL.com, September 14, 2022. https://www.al.com/news/2022/09/tubervilles-financial-trades-include-20-possible-conflicts-of-interest-with-senate-business.html

- Koplowitz, H. “Tuberville vowed to dump Chinese stock, then bought more.” AL.com, January 14, 2022. https://www.al.com/news/2022/01/tuberville-vowed-to-dump-chinese-stock-over-communism-then-bought-more.html

- Lyman, B. “Report: Tuberville traded stocks in industries with business before Senate.” Montgomery Advertiser, September 13, 2022. https://www.montgomeryadvertiser.com/story/news/politics/2022/09/13/senator-tommy-tuberville-stock-conflicts-committee-alabama-new-york-times/69491542007/

- Market Rebellion. The Street, September 7, 2022. https://www.thestreet.com/investing/options/tuberville-and-pelosi-two-recent-well-timed-congressional-trades

- Moon, J. “Watchdog group files ethics complaint against Sen. Tuberville.” Alabama Reporter, August 2, 2021. https://www.alreporter.com/2021/08/02/watchdog-group-files-ethics-complaint-against-sen-tuberville/

- Moorcraft, B. “‘Politicians have too much power’: Sen. Tommy Tuberville just disclosed $250K in futures trading in wheat, corn, soy and cattle — all while influencing agricultural.” Moneywise, August 16, 2023. https://moneywise.com/news/top-stories/tuberville-stock-disclosures

- Poritz, I. “Tommy Tuberville’s stock trades during infrastructure talks raise questions about conflicts of interest.” OpenSecrets, September 1, 2021. https://www.opensecrets.org/news/2021/09/tubervilles-stock-trades-during-infrastructure-talks-raise-questions-conflicts-of-interest/

- Reynolds, N. “Republican Senator’s Stock Trade Linked to Ukraine War Raises Eyebrows.” Newsweek, August 17, 2023. https://www.newsweek.com/republican-senator-stock-trade-linked-russia-war-raises-eyerbrows-1820658

- Rojas, W., DeChalus, C., Leonard, K., & Levinthal, D. “At least 15 lawmakers who shape US defense policy have investments in military contractors.” Business Insider, December 13, 2021. https://www.businessinsider.com/congress-members-are-trading-defense-stocks-while-shaping-military-policy-2021-12

- Seddiq, O. “Sen. Tommy Tuberville, who violated stock-trading rules 132 times last year, says it’s ‘ridiculous’ to ban lawmakers from trading stocks.” Business Insider, February 9, 2022. https://www.businessinsider.com/tommy-tuberville-ridiculous-to-ban-lawmakers-from-trading-stocks-2022-2

- Seddiq, O. “Sen. Tommy Tuberville invested in a Chinese company with communist party ties.” Business Insider, June 2021. https://www.businessinsider.com/tommy-tuberville-invested-in-chinese-company-with-communist-party-ties-2021-6