Property Insurance Crisis Intensifies in Florida as Premiums Soar 200% Since 2018

Quick Summary:

- Florida homeowners are now paying over $4,200 annually for home insurance, three times the national average.

- Insurance premiums have increased by 206% since Governor Ron DeSantis took office in late 2018.

- The crisis places pressure on DeSantis amidst his bid for the 2024 presidential election as major insurers continue to exit the state.

- Critics accuse DeSantis of failing to stabilize the volatile market and focusing more on the 2024 race than on affordable insurance for Floridians.

- High insurance costs in Florida are attributed to several factors, including extreme weather, excessive litigation, and fraudulent roof-replacement schemes.

Skyrocketing Insurance Premiums: Since Governor Ron DeSantis took office in 2018, Florida homeowners are bearing the burden of a 206% surge in insurance premiums. With an average annual cost of $4,200, Florida’s home insurance now triples the national average, placing the state at the top for the highest insurance premiums in the country.

The Exodus of Major Insurers: Several insurance companies have pulled out of Florida, adding to the crisis. The most recent departure is Farmers Insurance, which announced it will stop offering new coverage for auto, home, and umbrella policies, affecting roughly 100,000 policies.

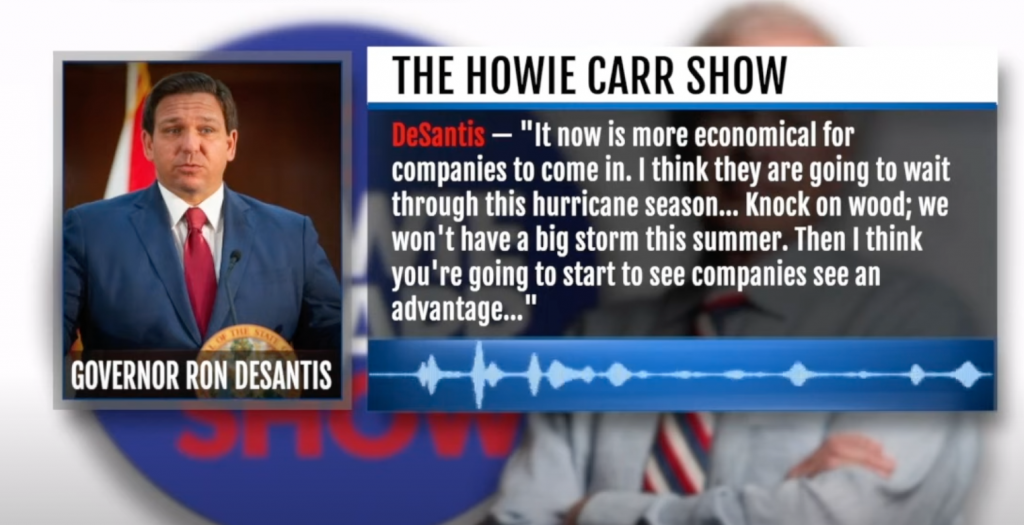

Political Pressure on DeSantis: The ongoing insurance crisis could impact Governor DeSantis’s potential 2024 presidential bid. Critics accuse him of failing to stabilize Florida’s volatile insurance market, suggesting his focus has been more on political aspirations than on ensuring affordable insurance for Floridians.

The Reasons Behind High Premiums: While the risks posed by extreme weather conditions, such as hurricanes and floods, are cited by insurers as reasons for their departure, experts note other causes. Florida leads in homeowners’ insurance-related litigation, with fraudulent roof-replacement schemes and high attorney fees being major contributors.

A Man-Made Catastrophe: According to Logan McFaddin, VP of state government relations at the American Property Casualty Insurance Association, Florida’s insurance crisis is “a man-made catastrophe” brought on by a thriving insurance market.

DeSantis’s Response: DeSantis’s press secretary, Jeremy Redfern, says the governor is seeking solutions to lower costs and attract more insurers. He assures that they are closely monitoring the market’s stability with the Office of Insurance Regulation, but notes that significant reforms will take time.

Read more at Newsweek.