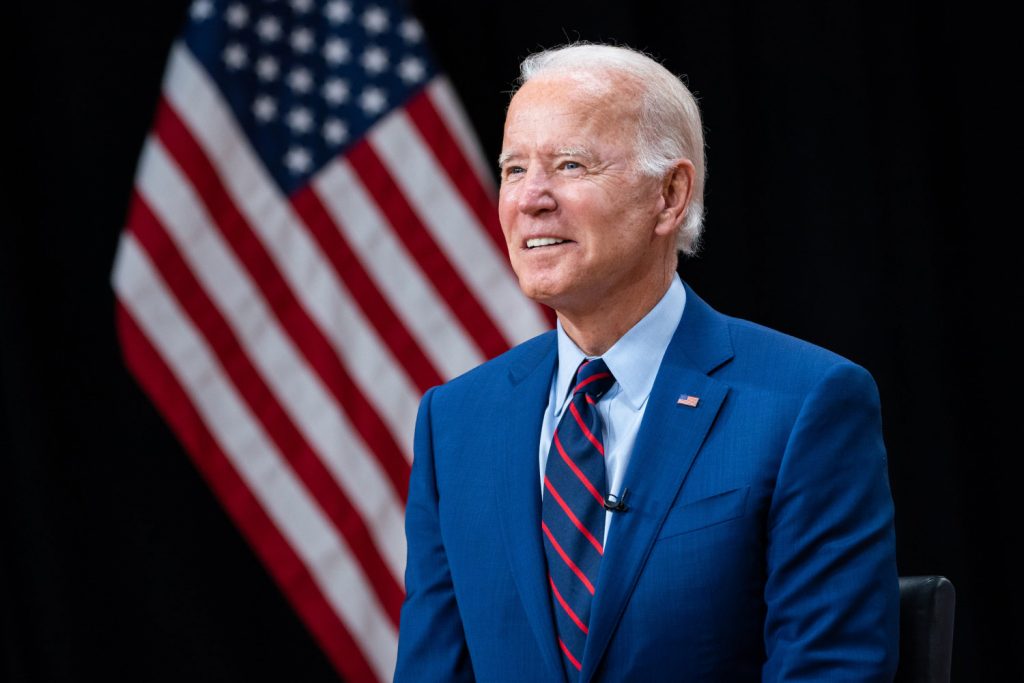

Despite Court Hurdle, Biden Charts Path Forward For Student Debt Relief

After the Supreme Court rejected President Joe Biden’s student loan relief plan, the Biden administration stepped up by exploring different legal mechanisms capable of providing similar types of student debt relief.

This article delves into the specifics of these initiatives, spanning from loan forgiveness for specific groups to the intricacies of repayment plans designed to ease the financial burden on borrowers.

Policy Summary:

- Biden Administration’s Initiative on Debt Cancellation:

- Aiming to provide student debt relief for about 804,000 borrowers.

- Focus on debt discharge for borrowers diagnosed with significant and permanent disabilities.

- Restructuring the U.S. Department of Education’s processes for more streamlined debt relief.

- Understanding the REPAYE and SAVE Plans:

- REPAYE (Revised Pay As You Earn) is an iteration of the original PAYE, offering benefits to a broader range of Direct Loan borrowers.

- SAVE Act targets the problem of frequent interest capitalization, aiming to make federal loans more manageable.

- Public Service Loan Forgiveness (PSLF) Overview:

- A pathway for student loan balance forgiveness after 120 qualifying monthly payments.

- Qualifying employers include government organizations and certain not-for-profits.

- Recent adjustments have added flexibility to the repayment strategy and expanded the range of loans considered.

- Income-Driven Repayment (IDR) Plans:

- Flexible repayment strategies that align loan payments with a borrower’s income and family size.

- Potential loan forgiveness after 20 or 25 years of consistent repayment.

- Biden’s strategy emphasizes the role of IDR plans in making repayment manageable for all borrowers.

The overarching theme is the Biden administration’s compassionate and practical approach to student loans, ensuring that higher education remains an accessible dream for many, without the looming threat of insurmountable debt.

Biden Administration’s Initiative on Debt Cancellation for 804,000 Borrowers

President Biden’s administration, acutely aware of the student debt crisis, has embarked on comprehensive steps to provide relief.

- Magnitude of Debt Relief: Specific to this initiative, the administration is set on providing student debt relief to approximately 804,000 borrowers. This plan indicates a concerted effort to diminish the burdens many Americans face due to mounting student loan obligations.

- Debt Discharge for Borrowers with Disabilities: As stated by the U.S. Department of Education, the administration has committed to erasing billions in student debt for individuals diagnosed with significant and permanent disabilities. Recognizing that this segment of society grapples with health and economic challenges, this debt discharge becomes a monumental gesture of support.

- Operational Mechanisms: The U.S. Department of Education is not just content with announcing these changes; they’re restructuring the very processes that govern debt relief. By leveraging inter-departmental data, they intend to automatically identify eligible borrowers, eliminating the bureaucratic rigmarole that previously hindered many from claiming the relief they were due.

- Public Service Loan Forgiveness (PSLF) Enhancement: Details from Student Aid indicate that the administration is particularly attentive to the PSLF program. To qualify, borrowers must make 120 qualifying monthly payments while working full-time for an eligible employer. The recent changes, especially in light of the CARES Act, mean that even months where payments were paused due to the pandemic are now counted as qualifying payments. This, combined with the flexibility to certify employment periodically and the introduction of new rules around consolidation loans, makes the pathway to loan forgiveness under PSLF clearer and more accessible.

Furthermore, as part of the Biden administration’s overarching approach, there’s been a push to ensure that all eligible borrowers, especially those from marginalized communities, are aware of and can benefit from these debt relief initiatives. This commitment is not just about numbers but ensuring equity and fairness in the implementation.

These strategies, centered around the cancellation of debt for 804,000 borrowers, exemplify the Biden administration’s larger commitment to overhauling the student loan system and offering tangible relief to millions of Americans.

Understanding the SAVE and REPAYE Plans: Two Sides of the Same Coin

The REPAYE plan, or Revised Pay As You Earn, is a newer version of the original Pay As You Earn (PAYE) plan, specifically crafted to assist borrowers with Direct Loans.

Key Aspects of REPAYE:

- Eligibility: REPAYE was introduced to extend the benefits of the original PAYE to a broader group of borrowers. All Direct Loan borrowers are eligible regardless of when they first received their loans, which means more people can capitalize on this plan.

- Payment Calculation: Monthly payments under REPAYE are set at 10% of the borrower’s discretionary income. However, the plan ensures that the monthly payments never exceed what would have been paid under the Standard Repayment Plan.

- Interest Subsidy: If the monthly interest accruing on loans is more than the monthly repayment under REPAYE, the government might subsidize a part of the remaining interest, ensuring reduced financial strain on the borrower.

- Duration: The repayment period varies. For undergraduate loans, any remaining balance is forgiven after 20 years of qualifying payments. For those with any graduate or professional study loans, it stretches to 25 years.

SAVE (Student Aid Valuable Enhancement) Act:

The SAVE Act represents a pivotal legislative attempt to fortify student loan repayment provisions, especially around interest accrual.

Key Aspects of SAVE:

- Interest Accrual Limitation: One of the principal pillars of the SAVE Act is its limitation on student loan interest capitalization. When entering repayment or switching repayment plans, interest won’t capitalize more than once every 12 months. This is significant because frequent interest capitalization can exponentially increase the amount students owe.

- Federal Loans Impact: The SAVE Act is crucial for those with federal student loans. By ensuring that unpaid interest does not capitalize frequently, it reduces the snowball effect of accumulating interest, making loans more manageable in the long run.

- Borrower-Friendly: By preventing the rapid compounding of interest, the SAVE Act is inherently borrower-friendly. It directly targets the stress point of many borrowers – the spiraling interest – and offers a substantial respite.

Both REPAYE and the SAVE Act exhibit the federal government’s sustained commitment to refining student loan policies, ensuring they align more closely with borrower needs and economic realities. Their introduction and the features they encapsulate are demonstrative of an evolving landscape, one that leans towards more borrower-friendly repayment conditions.

Comparatively, the SAVE plan provides a more extensive canopy of relief, while REPAYE offers specifics, especially considering different study levels.

Public Service Loan Forgiveness (PSLF): A Detailed Overview

The Public Service Loan Forgiveness (PSLF) program acts as a beacon for those dedicated to public service, providing a pathway to alleviate student loan burdens.

Understanding PSLF:

The core principle of the PSLF program is to forgive the remaining student loan balance for borrowers after they’ve made 120 qualifying monthly payments, all while working full-time for a qualifying employer.

Key Components of PSLF:

- Qualifying Payments: The PSLF requires 120 qualifying monthly payments. Interestingly, these payments don’t have to be consecutive. For instance, a brief stint with a nonqualifying employer won’t negate previous qualifying payments.

- Qualifying Monthly Payment Details: A qualifying payment is one made post-October 1, 2007, during full-time employment with a qualifying entity. The payment should be under a qualifying repayment scheme and must equal the full amount shown on the bill. The CARES Act has provisions to ensure months with paused repayments due to the pandemic are still considered qualifying, provided the employment is certified for that time.

- Qualifying Repayment Plans: Payments made under income-driven repayment (IDR) plans are eligible for PSLF. Although the 10-year Standard Repayment Plan also counts, to truly benefit, borrowers might need to shift to an IDR plan. Some plans, like the Standard Repayment Plan for Direct Consolidation Loans, don’t qualify for PSLF.

- Eligible Employers: PSLF qualification mandates full-time employment with specific employers. These include government organizations at all levels (federal, state, local, or tribal), tax-exempt not-for-profit organizations, and other not-for-profits providing certain public services.

- Submission and Tracking: It’s wise to submit the PSLF form yearly or upon changing employers. Once submitted and eligibility is confirmed, loans transfer to the PSLF servicer, which keeps track of qualifying payments. Upon hitting the 120-payment mark, the remaining balance undergoes forgiveness.

Additional Specifics:

- Consolidation and Credit: If borrowers consolidate their loans, qualifying payments made on Direct Loans included in the consolidation loan get credited using a weighted average. So, it’s beneficial for borrowers to certify all their qualifying employment before consolidation to ensure accurate application.

- Payment Flexibility: There’s notable flexibility in qualifying payments. For instance, a borrower can make a qualifying payment even during deferments, forbearance, or a grace period. Moreover, periods of qualifying deferments or forbearances can be included in the 120 qualifying payments.

- Recent Adjustments: There’s a renewed focus on joint consolidation loans. Borrowers can now separate these, adding more flexibility to their repayment strategy. Another highlight is the inclusion of FFEL Program and Perkins loans. Payments from these loans, when consolidated into a Direct Consolidation Loan, contribute to the qualifying payment count.

By comprehensively addressing student loan challenges, the PSLF continues to serve as a cornerstone for those dedicated to the public good.

Income-Driven Repayment (IDR): A Comprehensive Overview

The United States has recognized the burgeoning student debt crisis and, in response, has introduced various plans to alleviate the burden on borrowers. Among these, the Income-Driven Repayment (IDR) plans stand out as a significant shift in approach.

What is IDR?

Income-Driven Repayment (IDR) plans are repayment strategies that align your monthly federal student loan payment with your income and family size. Unlike fixed monthly payment plans, IDR adjusts to the financial situation of the borrower, ensuring that the repayment amount is manageable and fair.

How does IDR work?

- Adjustable Payments: The core feature of IDR is its adaptability. Monthly payments are set based on your income and family size. As these variables change, so do the payments, ensuring that borrowers aren’t overwhelmed.

- Forgiveness Timeline: An attractive feature of IDR is loan forgiveness. If your loan isn’t fully repaid after 20 or 25 years (depending on the specific terms of your IDR plan), the remaining balance is forgiven. This means that consistent borrowers are rewarded in the long run.

- Tax Implications: A unique aspect of IDR is that the forgiven loan amount, after the 20 or 25-year period, is not considered taxable. This is a departure from some other forgiveness programs where the forgiven amount could be seen as taxable income.

Why is IDR crucial under Biden’s plan?

Biden’s student loan strategy places a strong emphasis on IDR plans. Recognizing the diverse financial situations of borrowers, the emphasis on IDR ensures that repayment is never a source of undue stress. By linking payments to income, the plan acknowledges the economic disparities and challenges many face, ensuring that higher education remains a right, not a privilege.

Specifics of the IDR Program:

- Eligibility: Not all borrowers qualify for every IDR plan. Each IDR plan has its own set of eligibility criteria which may be tied to when you became a borrower, your loan type, and other factors.

- Types of Plans: IDR comprises various plans including REPAYE (Revised Pay As You Earn), PAYE (Pay As You Earn), IBR (Income-Based Repayment), and ICR (Income-Contingent Repayment). Each of these plans has its own nuances and specifics, but all are rooted in the principle of payments based on income and family size.

- Application Process: Borrowers interested in IDR must apply and periodically recertify their income and family size. This is crucial as it ensures the monthly payment amounts are recalibrated to the borrower’s current financial situation.

- Interest Capitalization: While IDR can lead to lower monthly payments, it may also result in the capitalization of unpaid interest, which can increase the overall loan balance. However, this is balanced out by the eventual loan forgiveness after 20 or 25 years.

- Employment Certification: For borrowers aiming at Public Service Loan Forgiveness (PSLF), which can forgive loans in just 10 years, it’s essential to be on an IDR plan and certify employment regularly. This ensures the borrower is on track to meet the PSLF criteria.

Conclusion Biden’s approach to student loans indicates a paradigm shift towards ease, flexibility, and compassion. As we navigate this sea change, being informed remains our most potent tool.

This article is built on a foundation of facts and figures sourced reliably. For detailed, up-to-date information, consulting a financial advisor or official websites is always a prudent step.

Bibliography:

- Haslett, C. (2023, August 14). Biden administration begins canceling student loan debt for 804,000 borrowers. ABC News. Retrieved from https://abcnews.go.com/Politics/biden-administration-begins-wiping-student-loan-debt-804000/story?id=102264052

- Haslett, C. (2023, July 14). Biden administration to forgive $39 billion in student loan debts for 800,000 borrowers. ABC News. Retrieved from https://abcnews.go.com/Politics/fix-program-errors-education-department-forgive-student-loan/story?id=101232295

- U.S. Department of Education. (n.d.). The Biden-Harris Administration’s Student Debt Relief Plan Explained. Federal Student Aid. Retrieved from https://studentaid.gov/debt-relief-announcement

- Turner, C., & Olson, E. (2023, July 14). The Biden-Harris Administration’s Student Debt Relief Plan Explained. NPR. Retrieved from https://www.npr.org/2023/07/14/1187545921/student-loan-forgiveness-save-repayment

- Federal Student Aid. (n.d.). Public Service Loan Forgiveness Qualifying Employment. Retrieved from https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service#qualifying-employment