Historic Judgment: Trump and Company Fined Over $300 Million

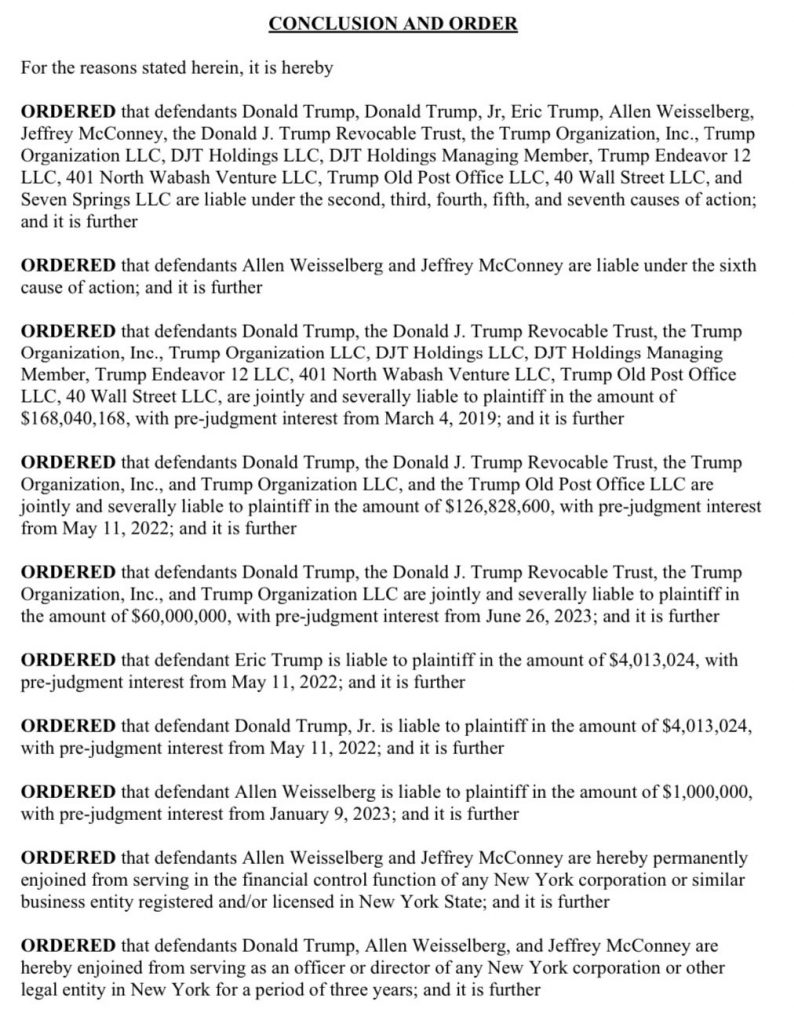

In a landmark decision, Judge Arthur Engoron has levied a more than $300 million fine against Donald Trump and the Trump Organization, following a civil business fraud trial that scrutinized the former president’s financial dealings. The ruling further prohibits Trump from holding an officer or director position in any New York corporation or legal entity for three years, marking a significant blow to Trump’s business operations within the state, according to reporting by NBC News.

- Donald Trump: $354,868,768

- Donald Trump, Jr: $4,013,024

- Eric Trump: $4,013,024

- Allen Weisselberg: $1,000,000

- Jeffrey McConney: No specific amount provided

Total Judgment Amount: $363,894,816

This judgment arrives amidst a tumultuous period for Trump, who faces additional legal challenges, including a recent $83.3 million defamation verdict and potential criminal trials. The New York Attorney General Letitia James initiated the lawsuit against Trump, his company, and top executives, accusing them of “repeated and persistent fraud” through exaggerated financial statements used to secure favorable loan and insurance rates. James sought $370 million in damages, citing fraudulent activities that allegedly netted the defendants substantial illicit gains.

Trump has consistently dismissed the allegations as politically motivated, asserting his financial statements were conservative and accusing James of targeting him unjustly. Throughout the trial, Trump’s demeanor was notably combative, especially towards James and Judge Engoron, whom he labeled as “extremely hostile” and a “hack.” This behavior led to a $15,000 fine for Trump after violating a partial gag order, which was imposed following his disparaging remarks about the judge’s law clerk that resulted in numerous death threats.

Key instances of alleged fraud highlighted during the trial include Trump’s overvaluation of his Trump Tower triplex and the inclusion of a brand value in the financial statements of his golf courses, contrary to the statements’ disclaimers. Particularly contentious was the valuation of Mar-a-Lago, Trump’s Florida residence and social club, which Trump asserted was worth significantly more than the appraised value determined by Palm Beach County assessors.

The investigation into Trump’s business practices was sparked by testimony from his former personal lawyer, Michael Cohen, in 2019. Cohen alleged Trump manipulated property values to benefit his business interests, leading to James’ lawsuit in 2022 and the subsequent appointment of a monitor for the Trump Organization’s finances. Judge Engoron’s pre-trial summary judgment found Trump and his executives guilty of repeated fraud, setting the stage for this conclusive ruling that undermines Trump’s business credentials and legal defenses.

As Trump plans to appeal the order, the implications of this judgment extend beyond the immediate financial penalties, posing significant challenges to his ongoing political ambitions and business ventures. This case underscores the legal and ethical scrutiny surrounding one of America’s most controversial figures, highlighting the intricate relationship between business practices, political power, and legal accountability.